Community Development

Supporting community development with investments, loans and services such as volunteers to provide financial education and technical assistance to nonprofits.

Personal Banking

Top 100 Largest Banks in the U.S.

Personal Checking

Saving & Money Market

Certificate of Deposit

Mortgage

Loans

Business Checking

Business

Loans

Global Treasury Management

Business Money Market & CDs

Business Banking

Top 2% SBA lender in the US.

Source: NAGGL Loan Production report as of 6/30/24

Security

FDIC Insured

The FDIC insures your deposits up to $250,000 per depositor, per insured bank, for each account ownership category.

Security First

We ensure a secure electronic environment for all your financial transactions.

Big Bank Security

Being among the largest 100 banks in the U.S., we offer the security of a large bank.

Privacy

We are committed to keeping your personal information, private.

Access through the Bank of Hope, Allpoint and MoneyPass networks are free; however, a fee may be charged for access through other ATM networks and may vary depending on the network provider.

Convenience

Mobile and Online Banking

Securely manage your banking 24/7 via Mobile and Online Banking. Learn More

Multilingual Banking

We have multi-lingual bankers (Korean, Chinese, Spanish and more).

Over 75,000 Surcharge-free ATMs

Access 75,000+ surcharge-free Bank of Hope, AllPoint and MoneyPass ATMs. Find ATMs

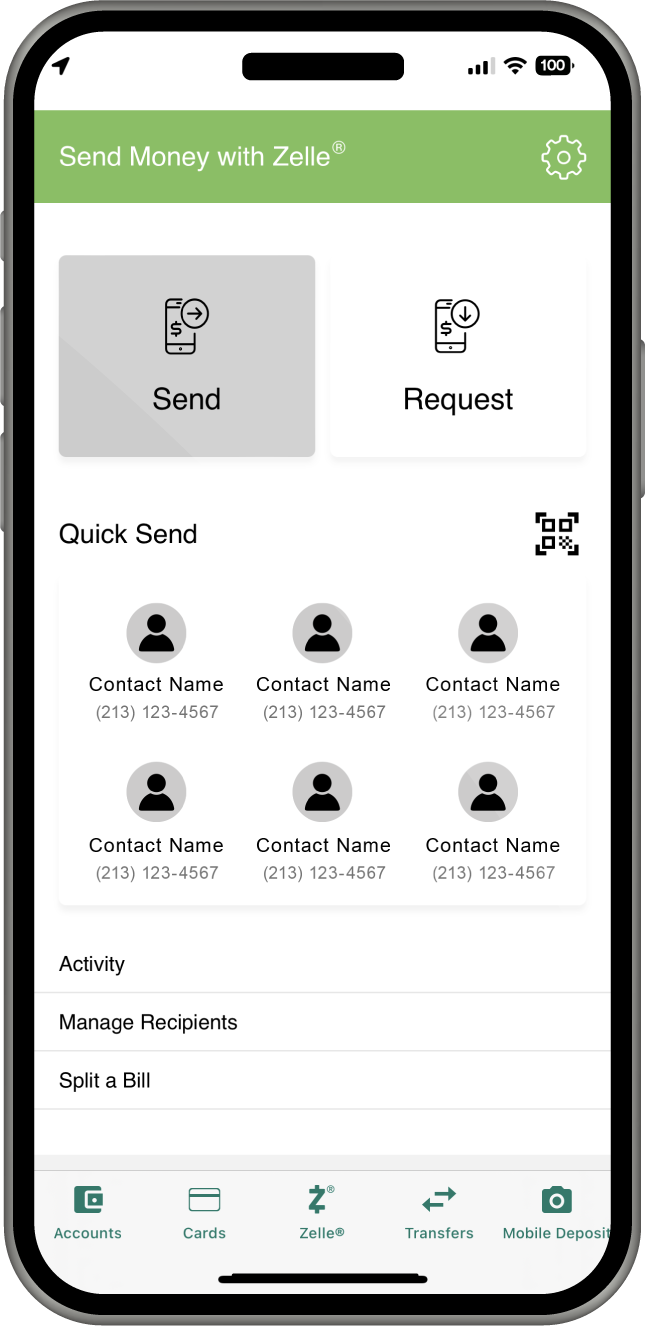

Zelle®

A fast, easy and safe way to send money digitally free of charge. Learn More

Access through the Bank of Hope, Allpoint and MoneyPass networks are free; however, a fee may be charged for access through other ATM networks and may vary depending on the network provider.