Online Banking Guide

|

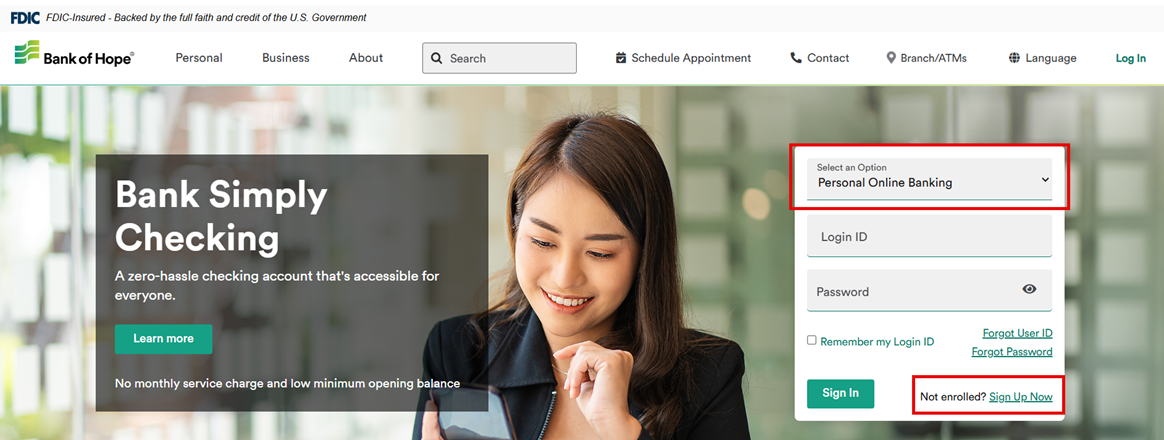

Step 1. Go to www.bankofhope.com. Select Personal Online Banking and click Sign Up Now. |

|

|

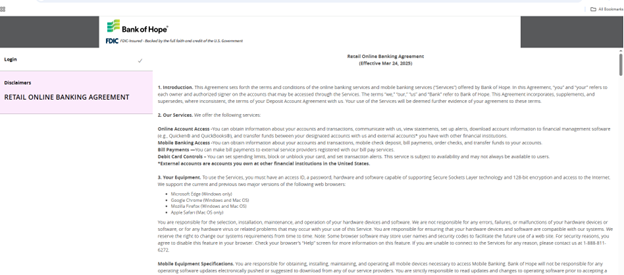

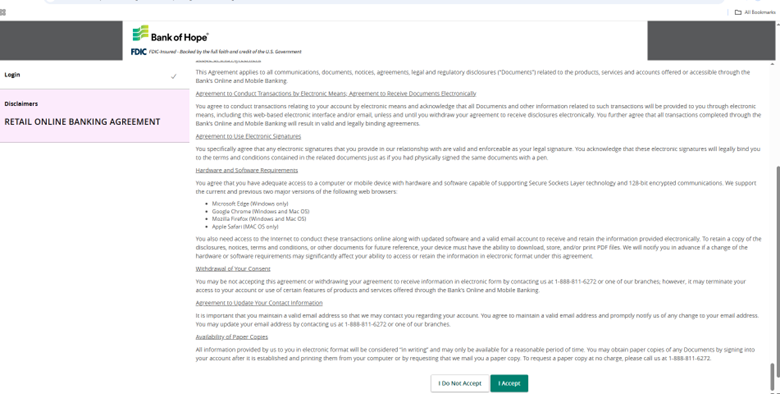

Step 2. Read through Retail Online Banking Agreement. Accept the terms of agreement by clicking 'I Accept'. |

|

|

Step 3. Fill out the Online Banking Registration form. Click Continue. IMPORTANT:

|

|

|

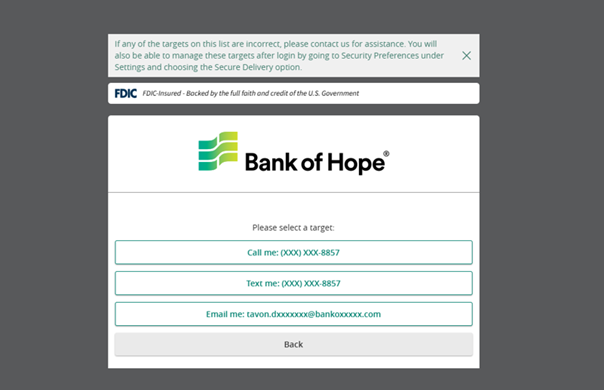

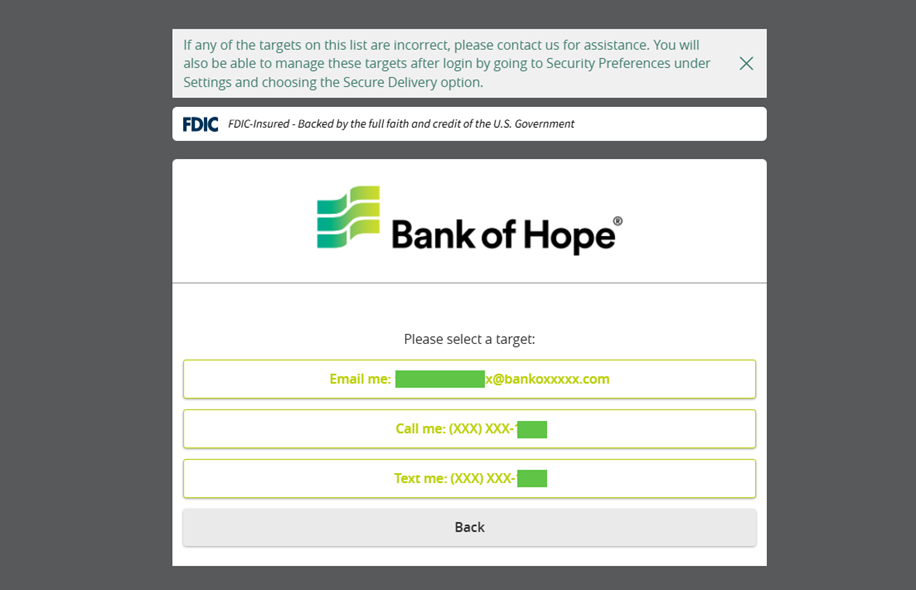

Step 4. Select method for receiving the Secure Access Code verification by choosing: Call Me Text Me Email Me |

|

|

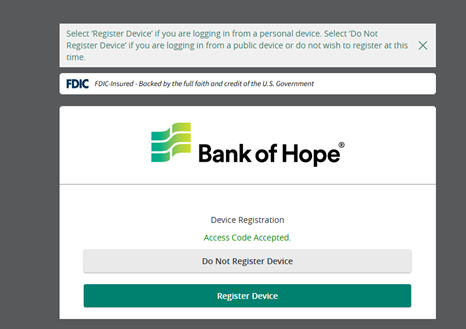

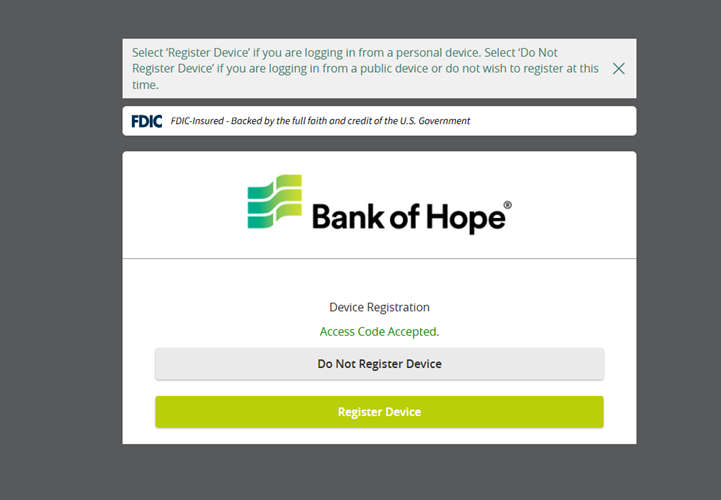

Step 5. Select if you would like to register your device.

|

|

|

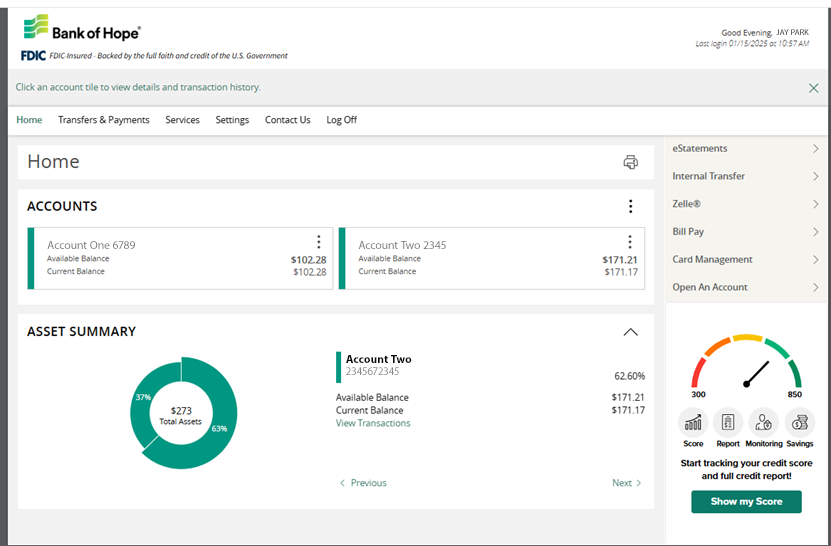

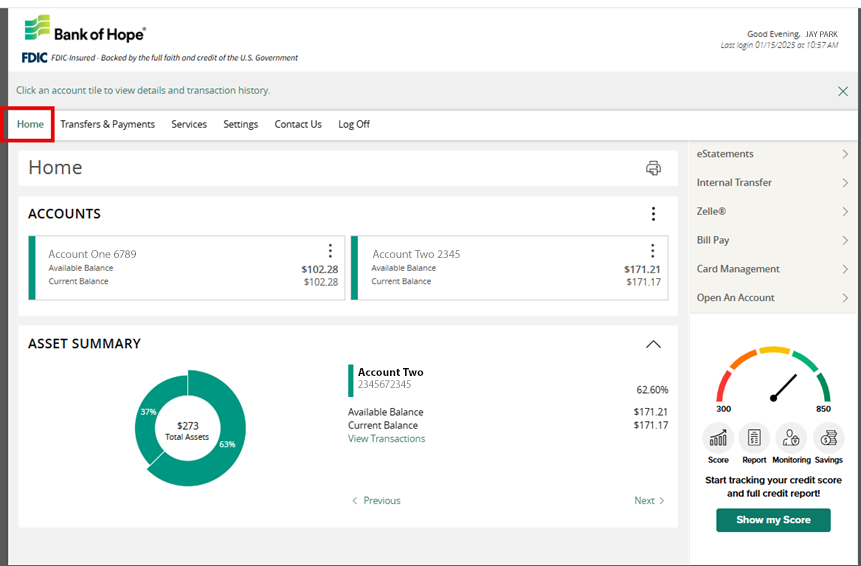

Step 6. Registration complete. Welcome to Bank of Hope Online Banking! |

|

|

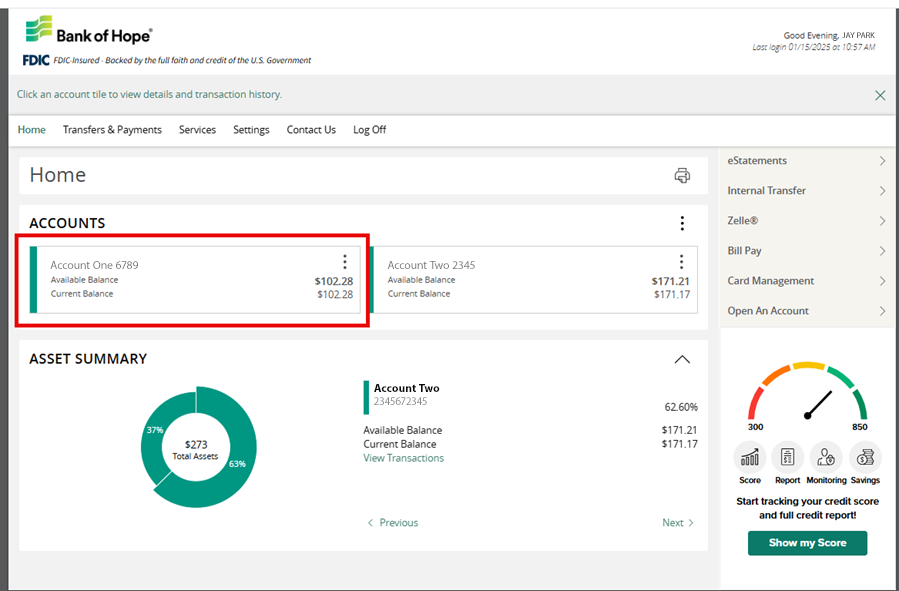

Once you log in, you will see a display of your account(s) on the Home screen. |

|

|

Step 1. Click Accounts in the menu on the right top. Click Account Activity. |

|

|

Step 2. Select the account title to view details and transactions history. |

|

|

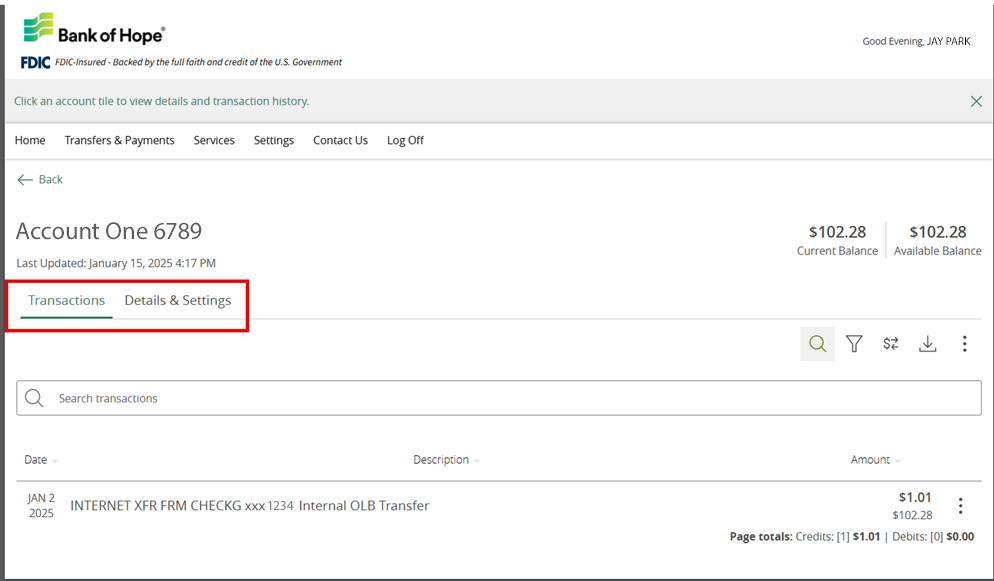

Step 3. Click on Transactions or Details & Settings for account information.

|

|

|

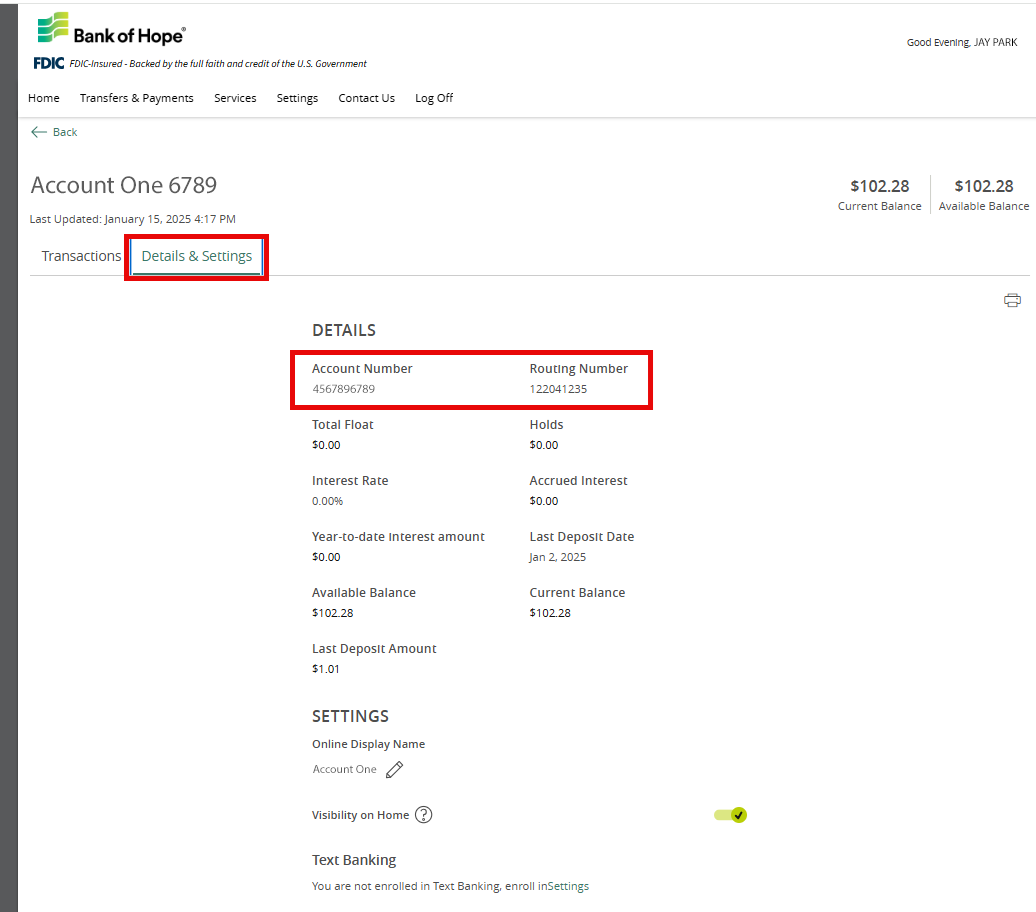

Select the account, then on the Details & Settings screen, you can view your full account number and routing number and other account-related details. |

|

|

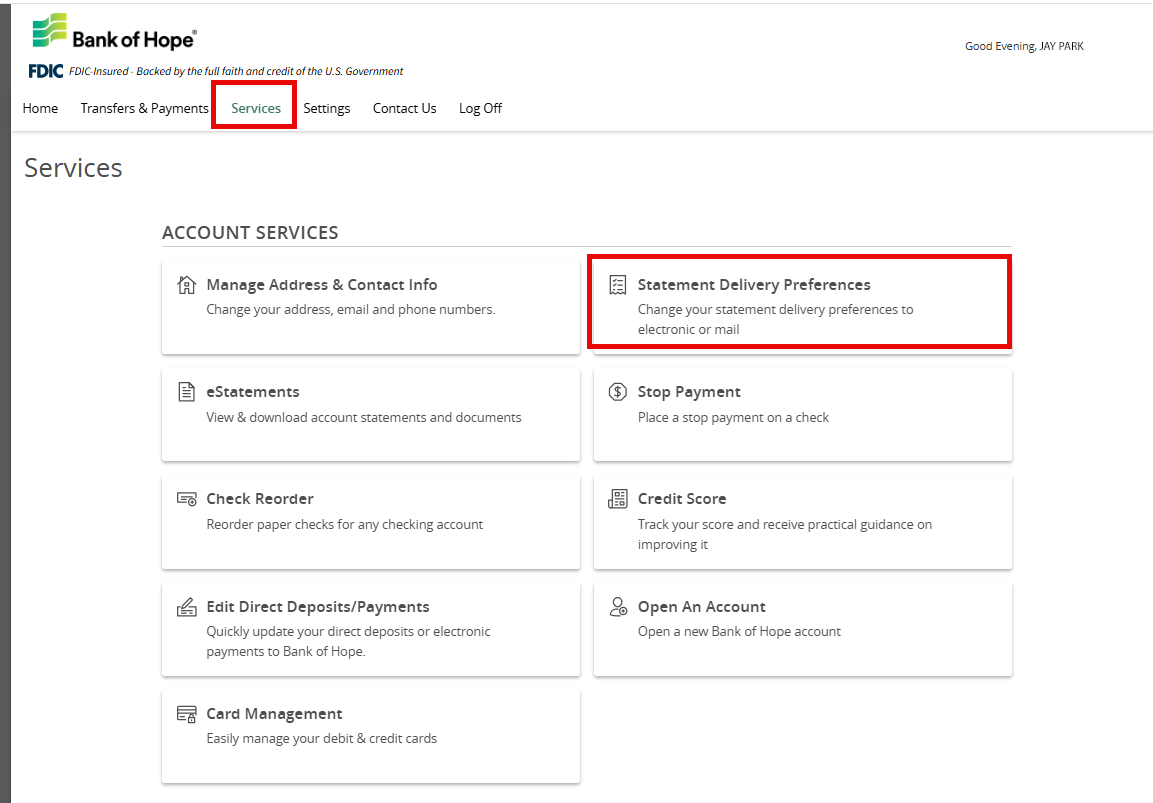

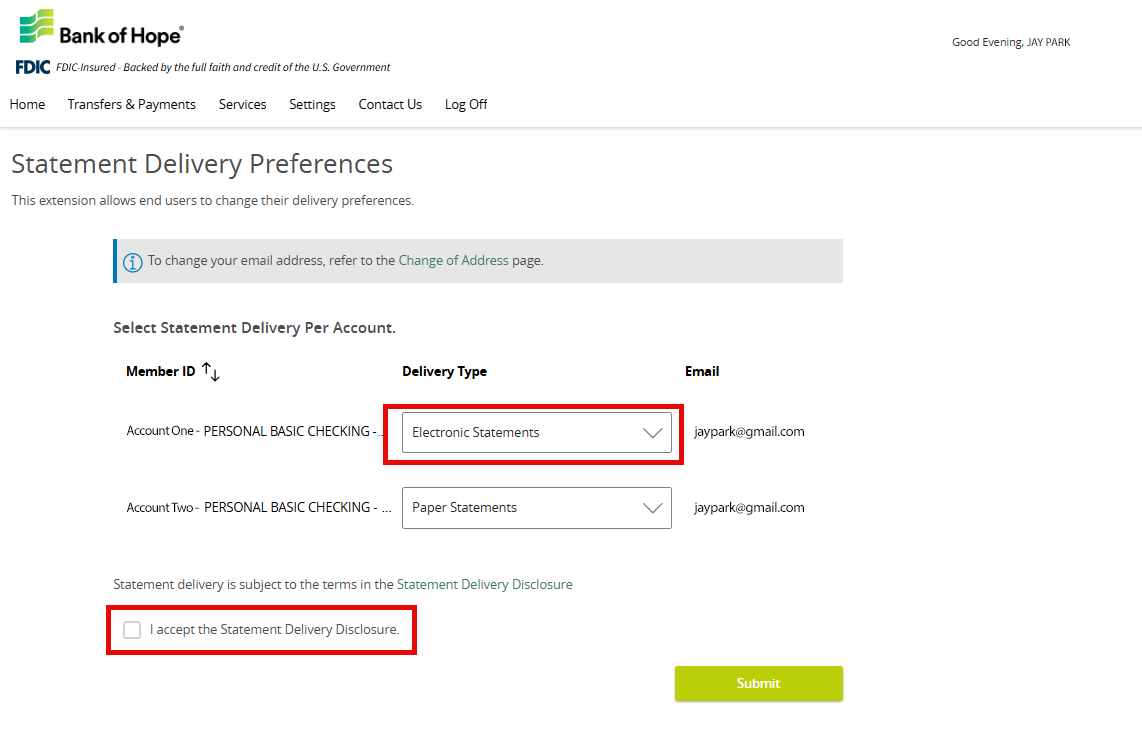

Step 1. Select Services option. Then, click on Statement Delivery Preferences. |

|

|

Step 2. Select the Delivery Type Preferences between Electronic Statements or Paper Statements and accept the Statement Delivery Disclosure then click Submit. |

|

|

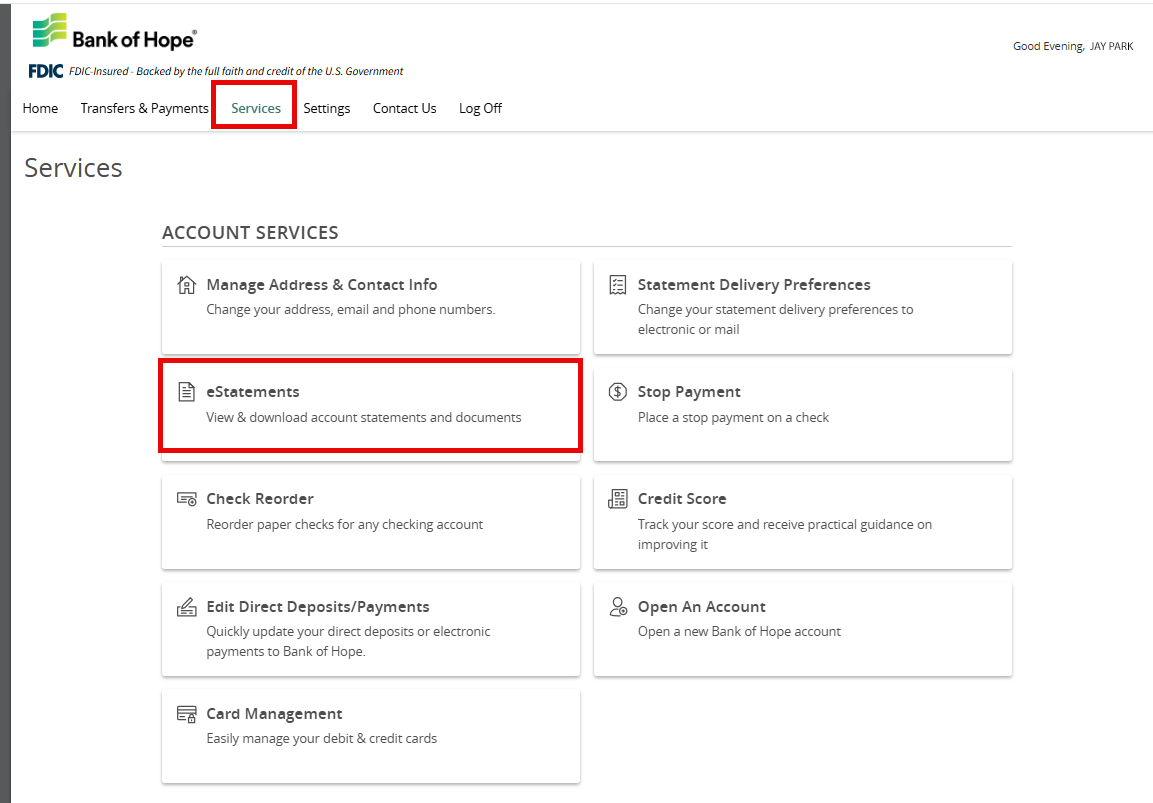

Step 3. Select Services option then click eStatements. |

|

|

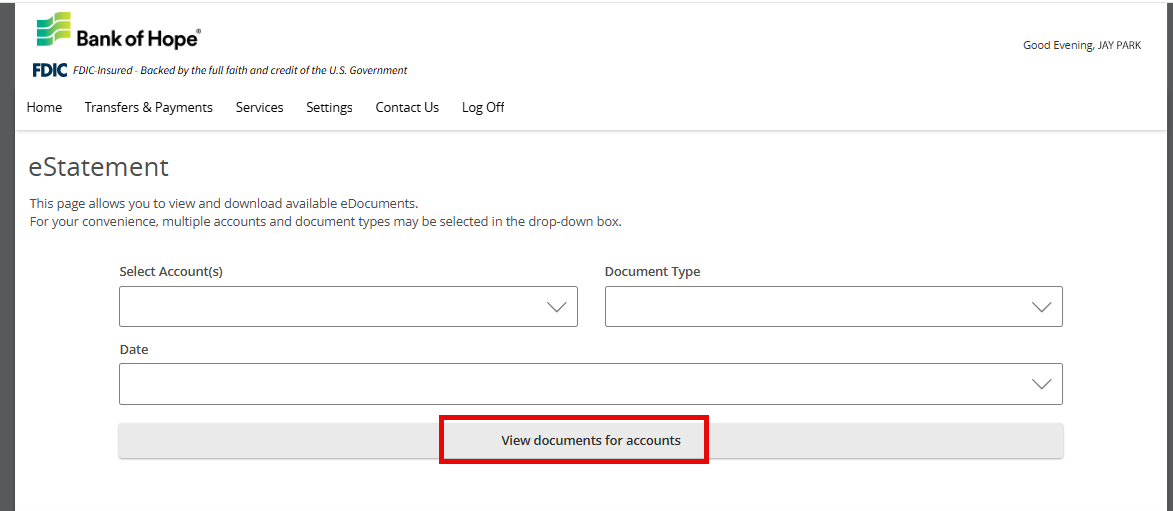

Step 4. On the e-Statements screen, select the following and click View documents for accounts.

|

|

|

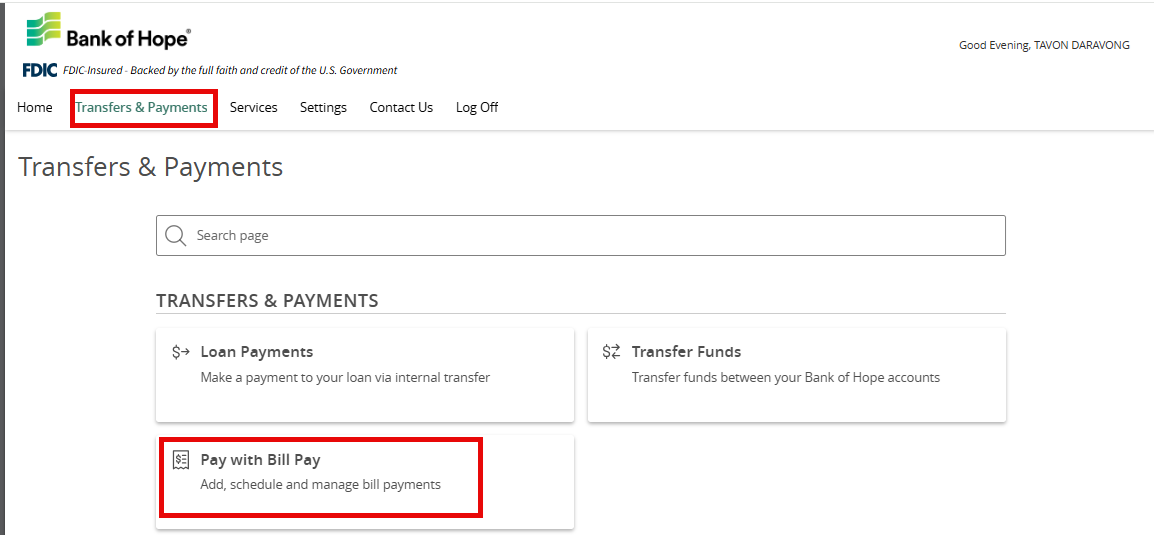

Step 1. Select Transfers & Payments then click on Pay with Bill Pay. |

|

|

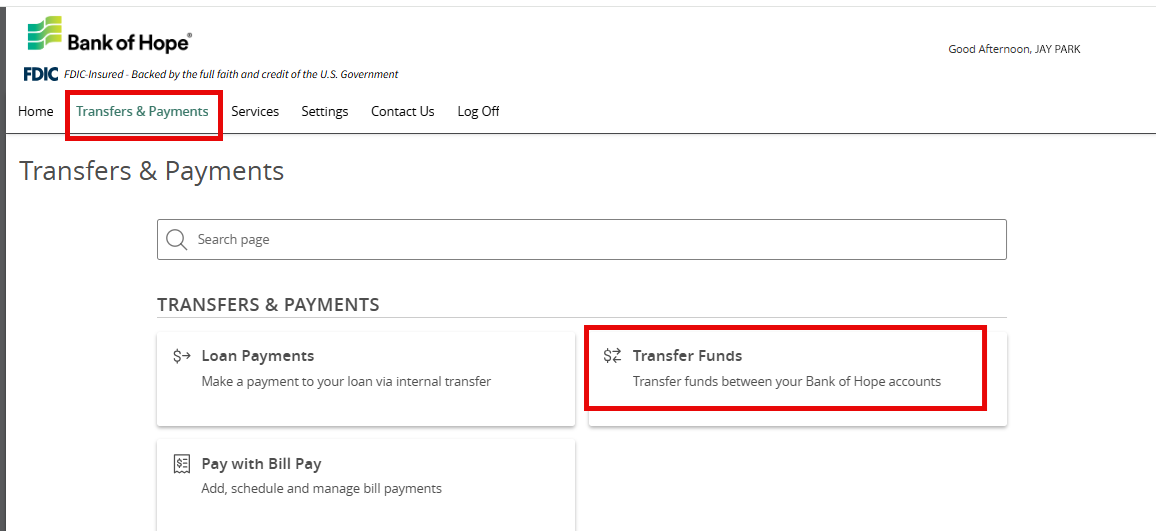

Step 1. Select Transfers & Payments then click on Transfer Funds. |

|

|

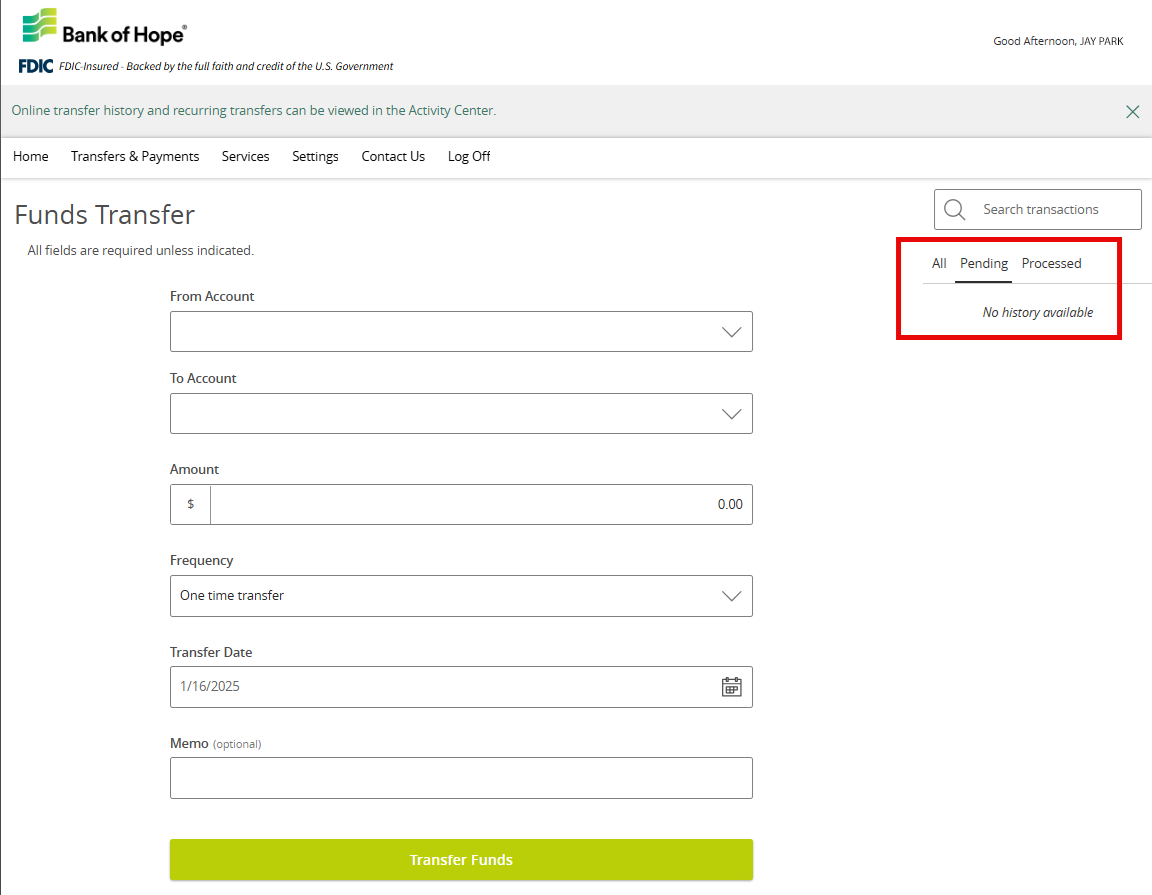

Step 2. Complete all fields and click Transfer Funds. |

|

|

Step 3. On the right side you can also Search Transactions, view “All, Pending, Processed” transactions. |

|

|

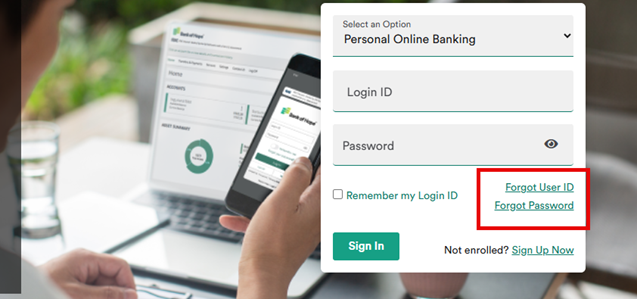

Step 1. If you forgot your password, you can reset your password. 1. Go to bankofhope.com. Click Forgot Password? under Personal Online Banking login section.

|

|

|

OR 2. If you failed your login, Forgot Password link appears. Click Forgot Password?. |

|

|

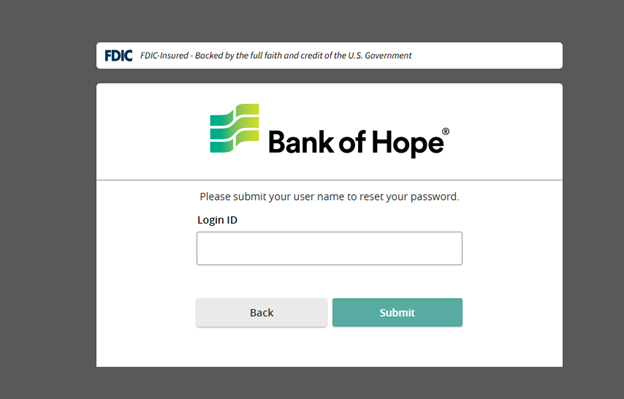

Step 2. Enter your Login ID and click Submit. |

|

|

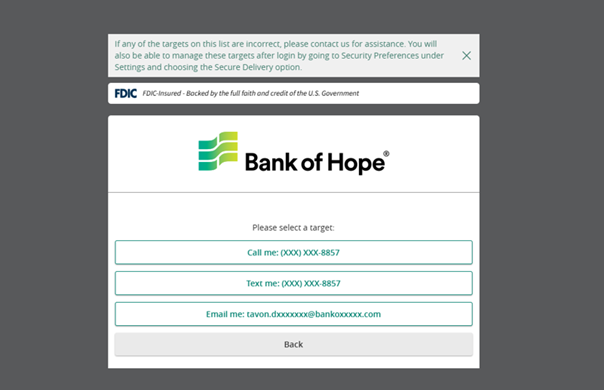

Step 3. Select method for receiving the Secure Access Code verification by choosing: Call Me Text Me Email Me |

|

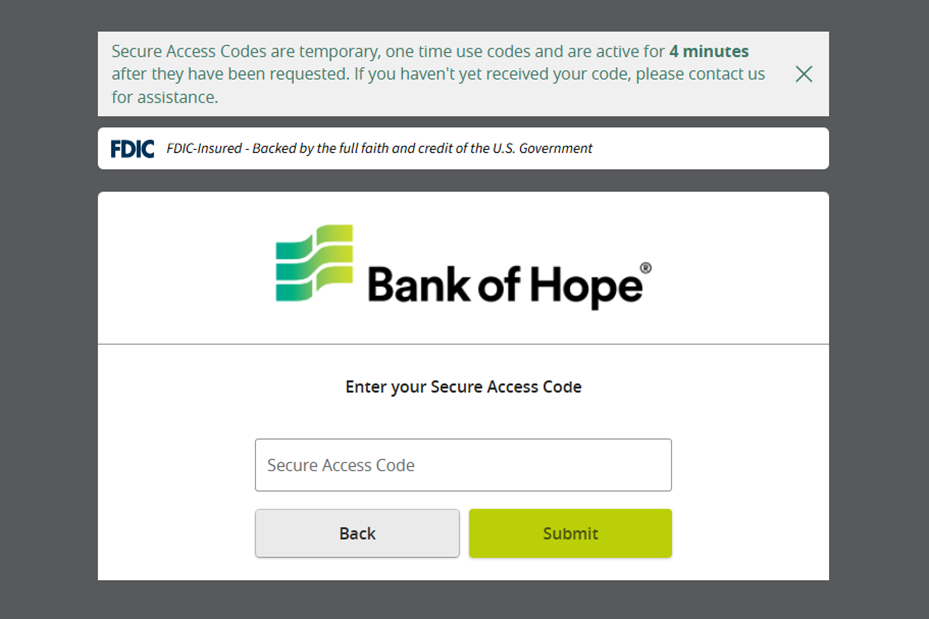

- Secure Access Code “SAC” are temporary, one time use codes and are active for 4 minutes after they have been requested.

- You will be prompted to select of the channel to receive the code. If you haven't yet received your code, please contact us for assistance.

- Keep your eyes out for the SAC to sent then enter the code to the Secure Access Code

- This is optional and always remember to use caution.

- Select Register Device if you are logging in from a trusted personal device.

- Select Do Not Register Device if you are logging in from a public device or do not wish to register at this time.

Mobile Banking Guide

|

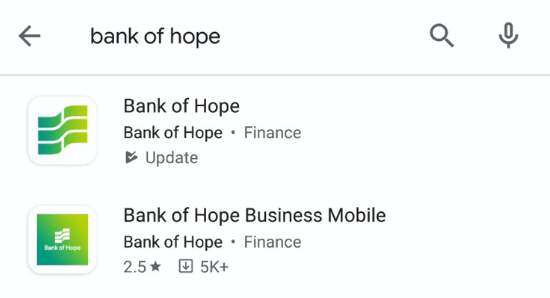

Step 1. Search “Bank of Hope” in the App Store (Apple iPhone) or Google Play Store

Step 2. Click the “Bank of Hope” app with a white background and green flag logo.

Step 3. Follow the instructions prompted by your device to download and install the app. |

|

|

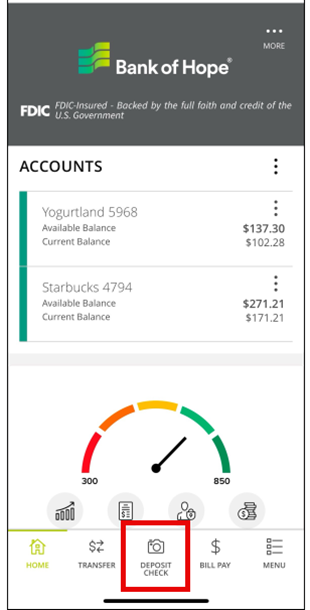

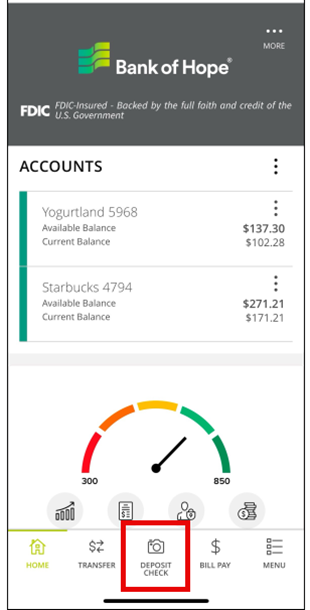

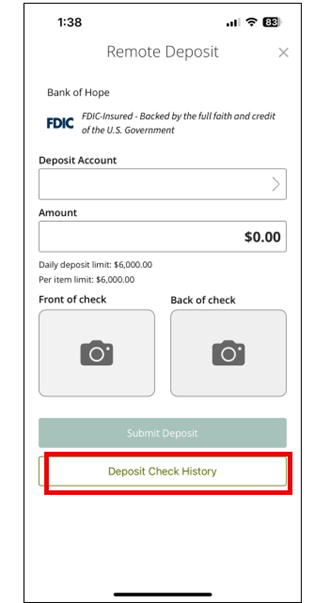

Step 1.

Within the mobile app, tap the 'Deposit Check' icon.

NOTE: Mobile deposits can only be done within the mobile app. (i.e. not from mobile browsers) |

|

|

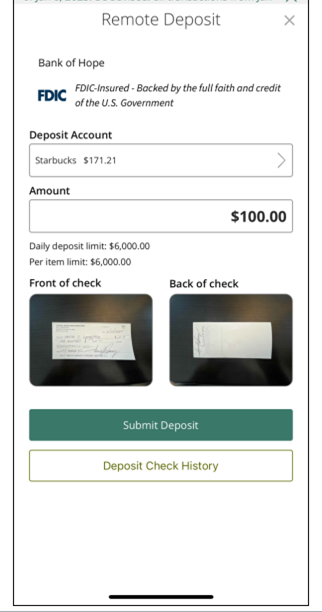

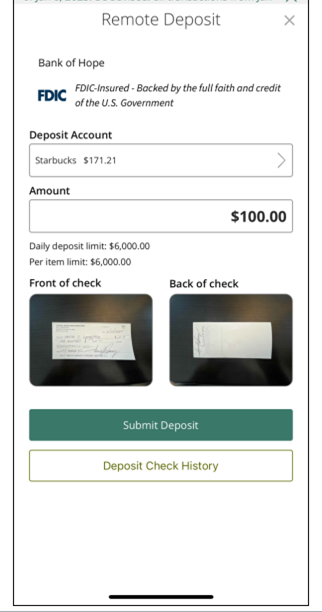

Step 2.

Select the 'Deposit Amount', enter amount, snap the front and back picture of the check to be deposited. |

|

|

Step 3. Tap 'Submit Deposit'. |

|

|

Step 1. |

|

|

Step 2. |

|

|

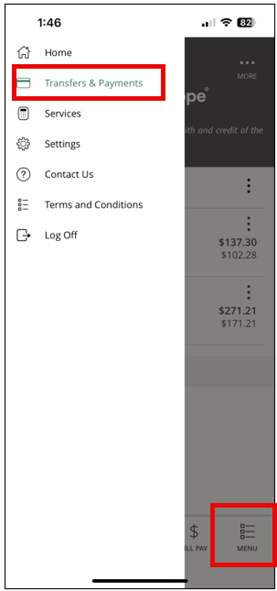

Alternative Step 1. Tap the 'Menu' icon on the the bottom right side of the mobile app and select 'Transfers & Payments'. |

|

|

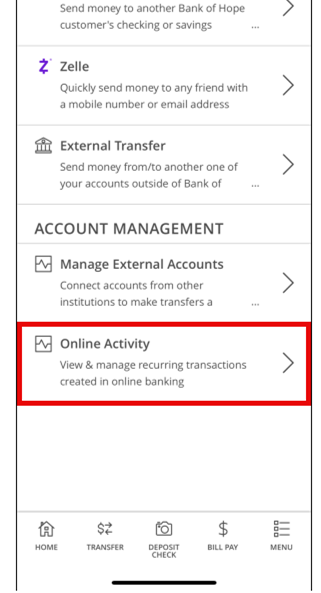

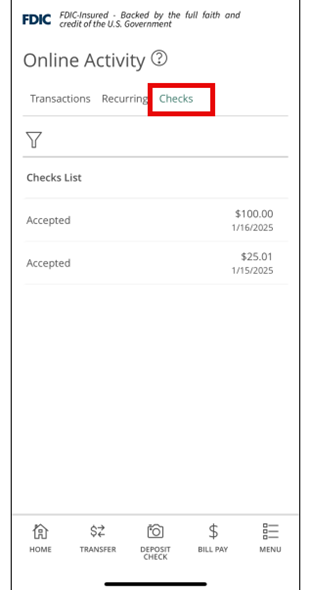

Alternative Step 2. |

|

|

Alternative Step 3. |

|

Need Help?

Digital Banking Help

Visit our learn more page for step by step instructional videos and guide

Contact us

Call Center / Mobile Banking:

1-855-325-2226

Hours

Mon-Fri: 5:30 am - 6:00 pm (PST)

Sat: 6:00 am - 1:00 pm (PST)